A Guide to Reaching IT Decision-Makers in Companies Using Cisco

The enterprise technology sales landscape has never been more competitive. With countless vendors vying for attention, knowing where to focus your efforts can mean the difference between spinning your wheels and building a robust pipeline.

Companies that have invested in Cisco infrastructure represent one of the most lucrative and identifiable targets in B2B technology sales.

This isn’t just about finding companies with deep pockets, though Cisco customers typically have those. It’s about identifying organizations with specific pain points, predictable procurement cycles, and decision-makers who are actively managing complex technology environments.

When you know a company runs on Cisco, you’re holding a roadmap to their priorities, challenges, and likely buying triggers.

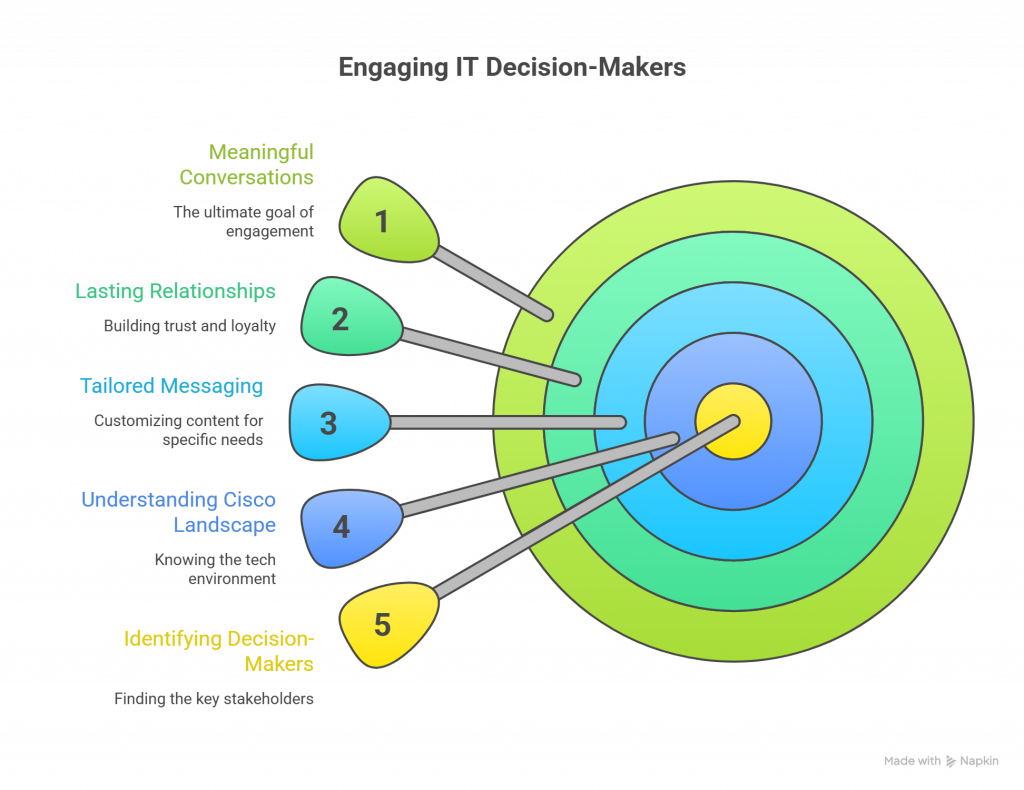

This guide will walk you through the complete process of identifying, researching, and reaching IT decision-makers in Cisco-centric organizations. Whether you’re selling complementary technology, professional services, or competing solutions, you’ll learn how to navigate the unique dynamics of these enterprise environments and build relationships that convert.

Understanding the Cisco Enterprise Ecosystem

Market Position and Prevalence

Cisco’s footprint in enterprise networking is staggering. The company commands approximately 50-60% market share in enterprise switching and maintains dominant positions in routing, security appliances, and unified communications.

This isn’t a company that’s merely present in the market; it’s the infrastructure backbone for a significant portion of Fortune 1000 companies and mid-market enterprises worldwide.

Financial services, healthcare, education, government, and technology sectors show particularly high Cisco adoption rates. Walk into almost any hospital system, university campus, or financial institution, and you’ll find Cisco switches powering their networks, Cisco firewalls protecting their perimeters, and often Webex facilitating their communications.

Understanding this prevalence matters because it allows you to make informed assumptions about your target accounts. A 500-person healthcare organization almost certainly runs some Cisco infrastructure.

A regional bank with multiple branches? Same story. These aren’t wild guesses; they’re statistically probable realities that should inform your targeting strategy.

Common Cisco Technology Stacks

Cisco customers rarely deploy just one product. The company’s ecosystem approach means organizations typically run multiple integrated solutions. A typical enterprise stack might include:

Core networking forms the foundation: Catalyst switches connecting endpoints, Nexus switches in the data center, and ASR or ISR routers handling WAN connectivity. These aren’t products that get replaced on a whim. Network refresh cycles typically run 5-7 years, representing substantial capital investments.

Security layers have become increasingly central to Cisco deployments. Firepower next-generation firewalls, Umbrella DNS-layer security, Duo multi-factor authentication, and increasingly, extended detection and response (XDR) platforms form integrated security architectures. The shift toward zero-trust models has made these security conversations more urgent and budget allocations more generous.

Collaboration infrastructure might include on-premises Unified Communications Manager, cloud-based Webex, or hybrid deployments combining both. The pandemic accelerated migration to cloud collaboration, creating ongoing technical debt conversations in many organizations.

Data center and cloud technologies round out the stack: hyperflex hyperconverged infrastructure, ACI software-defined networking, and increasingly, cloud-native integrations with AWS, Azure, and Google Cloud.

When you know which pieces of this puzzle your prospect has deployed, you can speak knowledgeably about their environment and demonstrate a genuine understanding of their challenges.

Company Profiles That Use Cisco

Not every company using Cisco looks the same, but certain patterns emerge. Organizations with 250+ employees that have invested in Cisco typically demonstrate several characteristics:

They’ve moved beyond commodity IT decision-making. These aren’t companies buying the cheapest option on Amazon Business. They have dedicated IT staff, formal procurement processes, and strategic technology planning cycles.

Their IT budgets typically represent 3-8% of revenue, with larger percentages in technology-dependent industries. A healthcare system running Cisco infrastructure might have a $10-20 million annual IT budget. A regional financial institution could exceed $50 million.

IT maturity correlates strongly with Cisco adoption. Organizations sophisticated enough to deploy and manage Cisco infrastructure typically have established change management processes, documented network architectures, and multi-year technology roadmaps. This maturity cuts both ways: they’re more methodical buyers, but they’re also capable of larger, more strategic purchases.

The IT Decision-Making Hierarchy in Cisco Environments

Key Stakeholder Roles

Understanding who actually makes buying decisions in Cisco-centric organizations requires mapping both formal authority and practical influence. The org chart rarely tells the complete story.

The C-Suite sets strategic direction and controls budgets, but their day-to-day involvement in technology decisions varies dramatically. A CIO at a 1,000-person company might personally evaluate networking solutions. At a 10,000-person enterprise, they’re approving business cases, not comparing technical specifications.

Chief Information Security Officers (CISOs) have gained significant influence and often control separate budgets. In highly regulated industries or organizations that have experienced security incidents, the CISO may have final say on security-related infrastructure purchases regardless of traditional IT hierarchy.

IT Directors and VPs typically drive the actual evaluation and selection process. The VP of Infrastructure or Director of Network Operations lives with the consequences of technology decisions daily. They balance business requirements against technical reality, manage vendor relationships, and quarterback procurement processes.

These mid-level executives often serve as gatekeepers. Win their trust, and they’ll champion your solution internally. Lose their confidence, and your proposal won’t survive the first cut, regardless of C-suite interest.

Technical decision-makers (network architects, senior systems engineers, security analysts) wield influence that outsiders frequently underestimate. A skeptical network architect can torpedo deals by raising technical objections during proof-of-concept phases. Conversely, an enthusiastic engineer can become your most valuable internal advocate.

Decision-Making Processes

Enterprise technology purchases follow predictable patterns, and Cisco environments tend toward the more structured end of the spectrum.

Capital expenditure approvals for infrastructure typically require business case justification demonstrating ROI, risk mitigation, or strategic alignment. A $500,000 network upgrade needs to solve specific problems or enable concrete business outcomes. “Our current equipment is old” rarely suffices—you need to articulate the business impact of that aging infrastructure.

Budget planning cycles generally run on fiscal year calendars. Organizations finalize budgets in Q3-Q4 for implementation starting the following January. This creates natural timing windows. Engaging prospects in May or June allows you to influence budget planning for the following year. Reaching out in February when budgets are locked means waiting until next cycle unless you’ve identified unbudgeted emergency spending.

RFP processes in larger organizations can extend 6-12 months from initial requirements gathering through contract signing. Cisco-centric companies often maintain preferred vendor relationships that create both obstacles (incumbent advantage) and opportunities (frustrated stakeholders seeking alternatives).

Understanding these timelines and processes prevents wasted effort and appropriately sets expectations.

Pain Points and Priorities

IT decision-makers in Cisco environments wrestle with recurring challenges that create buying opportunities:

Network modernization tops many lists. Organizations running aging Catalyst 3850s or ASR routers from 2015 face increasing maintenance costs, security vulnerabilities, and limitations supporting modern applications. SD-WAN migration represents a particularly common pressure point as companies seek to reduce MPLS costs and improve cloud application performance.

Security concerns have intensified dramatically. Ransomware, supply chain attacks, and sophisticated persistent threats keep CISOs awake at night. The shift toward zero-trust architecture creates opportunities for solutions that enhance security posture, whether complementary to existing Cisco security tools or competitive alternatives.

Cloud migration and hybrid infrastructure challenges persist. Organizations with substantial on-premises Cisco infrastructure must determine how to integrate with public cloud providers, manage hybrid connectivity, and potentially migrate workloads. These transitions create needs for professional services, new tooling, and expertise.

Cost optimization and licensing complexity frustrate many organizations. Cisco’s shift toward subscription licensing, software-based features, and complex SKU structures creates confusion and often results in over-purchasing or compliance concerns. Solutions that simplify management or reduce costs find receptive audiences.

Skills gaps may be the most persistent pain point. Finding and retaining engineers with deep Cisco expertise grows increasingly difficult as the talent pool ages and younger engineers gravitate toward cloud and DevOps technologies. Tools or services that reduce skills requirements or provide expert support address a critical need.

Research and Intelligence Gathering

Identifying Target Companies

Before you can reach decision-makers, you need to identify which companies warrant your attention. Several approaches yield quality target lists:

Technology intelligence platforms like BuiltWith, Datanyze, or ZoomInfo’s Scoops provide direct visibility into companies’ technology stacks. Search for organizations using specific Cisco products, filter by employee count and industry, and you’ll generate a targeted prospect list. These platforms vary in accuracy—expect 70-80% reliability—but they dramatically reduce spray-and-pray outreach.

A ZoomInfo search for companies with 500-5,000 employees in healthcare using Cisco Catalyst switches might return 1,200 organizations. That’s a manageable, highly targeted universe compared to contacting every healthcare organization in your territory.

LinkedIn Sales Navigator enables sophisticated filtering by company size, industry, and crucially, job titles. Search for “Network Engineer” or “Infrastructure Manager” at companies matching your ideal customer profile. The presence of these roles signals IT maturity and likely Cisco usage.

Job postings represent underutilized intelligence goldmines. A company hiring a “Senior Network Engineer with Cisco certification required” has just told you they run Cisco infrastructure, and they’re growing or replacing staff. Both scenarios create buying opportunities. Set up alerts on Indeed, LinkedIn Jobs, and industry-specific boards for relevant positions.

SEC filings and annual reports for public companies often mention significant technology vendors. Search the 10-K filing for “Cisco,” and you’ll frequently find references to contracts, dependencies, or strategic relationships.

Read More: 6 Tips for Lawyers to Ethically Attract New Clients

Cisco’s own partner directory and case studies advertise customer relationships. While not comprehensive, these resources identify companies publicly committed to Cisco infrastructure.

Understanding Organizational Structure

Identifying target companies represents just the first step. Understanding their internal structure and key stakeholders requires deeper research.

LinkedIn becomes invaluable here. Search for employees at your target company with IT-relevant titles, then map their relationships. Who reports to whom? How large is the IT organization? Are networking and security separate teams or integrated?

Look for patterns that suggest organizational structure. If you see a VP of Infrastructure, a VP of Security, and a VP of Applications all at the same company, you’re likely looking at a larger, more compartmentalized IT organization. This suggests more complex buying processes with multiple stakeholders.

Recently hired decision-makers present particularly attractive opportunities. Someone joining as a new CTO, VP of Infrastructure, or Director of IT within their first 90 days often brings fresh perspectives and a willingness to reconsider vendor relationships. They haven’t yet invested political capital in existing vendors and may be building their team or establishing credibility through strategic initiatives.

Pay attention to tenure. A CIO who’s been in the role for eight years likely has established vendor relationships and preferences. A CIO in month three is still evaluating options.

Trigger Events and Timing

The best time to reach a decision-maker isn’t random—it’s when they’re actively dealing with relevant challenges. Trigger events create buying urgency:

Mergers and acquisitions force infrastructure consolidation decisions. When two companies combine networks, someone must reconcile different vendors, architectures, and approaches. These integrations create opportunities for new vendors to displace incumbents.

Monitor merger announcements in your target industries. When you see two healthcare systems combining, both likely run some Cisco infrastructure that must be integrated or standardized.

Office relocations or expansions require network buildouts. A company announcing a new headquarters or regional office needs switching, wireless, security, and WAN connectivity. Fresh installations offer opportunities to introduce new vendors.

Security breaches or compliance requirements create urgent buying needs. When a company announces a data breach (often in SEC filings or news coverage), you can safely assume their CISO is under pressure to improve security posture. New regulations like CMMC in defense contracting or state privacy laws create similar compliance-driven urgency.

Cisco end-of-life announcements generate waves of replacement buying. When Cisco declares popular products end-of-sale or end-of-support, thousands of organizations must decide whether to buy final batches of familiar products or transition to new platforms. These transitions create opportunities for competitive alternatives.

Track Cisco’s EOL schedules and identify customers running affected equipment. A company with Catalyst 3850 switches reaching end-of-life faces a forced decision within 12-24 months.

Budget cycles create predictable windows. Most calendar-year companies finalize next year’s budgets in September-November. Fiscal year companies follow different cycles. Understanding your prospect’s fiscal year allows you to time engagement when they’re planning expenditures rather than after budgets are locked.

Multi-Channel Outreach Strategies

LinkedIn Engagement

LinkedIn has evolved from a digital resume repository to an essential B2B sales channel. For reaching IT decision-makers, it’s often more effective than email.

Profile optimization matters more than most salespeople realize. IT decision-makers routinely review the profiles of people trying to connect. A sparse profile with a generic headshot and “Sales Executive” title inspires little confidence. A profile demonstrating relevant industry experience, technical knowledge, and genuine expertise in solving problems similar to their challenges earns consideration.

Include recommendations from IT leaders you’ve worked with previously. Share content relevant to Cisco environments—articles about network modernization, security trends, or cloud migration challenges. Position yourself as a knowledgeable resource, not just another salesperson.

Personalized connection requests dramatically outperform generic invitations. Reference their specific environment: “I noticed you manage infrastructure at [Company] and saw you’re running Cisco collaboration tools. I work with healthcare IT leaders navigating similar environments and thought it might be valuable to connect.”

This approach demonstrates you’ve done research and have relevant expertise. It’s not guaranteed, but 30-40% acceptance rates are achievable compared to 10-15% for generic requests.

Content engagement strategies build familiarity before direct outreach. Comment thoughtfully on posts from your target decision-makers. Share relevant articles and tag them when appropriate. This creates multiple touchpoints and establishes you as someone who understands their world.

When a VP of Infrastructure posts about network transformation challenges, a substantive comment offering perspective or resources gets noticed. Do this consistently for 2-3 weeks before sending a connection request, and you’ll see higher acceptance rates.

InMail best practices apply when connecting with executives outside your network. Keep messages brief—three to four sentences maximum. Lead with relevance to their specific situation, not your product’s features. Make a clear, low-commitment ask like a 15-minute call to share relevant insights, not a product demo.

Test subject lines relentlessly. “Quick question about your Cisco environment” generates better open rates than “Reducing network costs at [Company]” in most cases, though results vary by audience.

Email Campaigns

Email remains highly effective for reaching IT decision-makers, but only when executed thoughtfully.

Subject line formulas that work with technical audiences tend toward specificity over creativity. “How [Similar Company] reduced Cisco licensing costs 30%” outperforms “You won’t believe this network cost reduction trick!” in every test we’ve seen.

Questions work well: “Still managing Cisco configs manually?” or “Planning for Cat 3850 EOL?” demonstrate understanding of likely pain points.

Avoid spam triggers—excessive capitalization, multiple exclamation points, or misleading urgency (“URGENT: Your network is at risk”). IT professionals delete these reflexively.

Personalization using Cisco stack details transforms generic outreach into relevant conversations. “I noticed you’re running Firepower firewalls based on your recent job posting for a security engineer.” shows research and creates a specific context for your value proposition.

Reference their specific Cisco products, office locations, or industry-specific challenges. Generic “IT leaders in your industry face challenges” messages get ignored. “Healthcare networks running Cisco infrastructure face specific HIPAA compliance challenges with cloud migration” gets read.

Value propositions aligned with specific pain points convert better than feature lists. Don’t tell an infrastructure director about your product’s 47 features. Tell them how you’ve helped similar organizations reduce network downtime from 12 hours annually to under 2 hours, or cut WAN costs by 40% while improving application performance.

Connect features to outcomes: “Our automated config management integrates with Cisco DNA Center to reduce change-related outages” beats “We offer automated config management.”

Follow-up sequencing and cadence require balance. IT decision-makers aren’t sitting idle waiting for your emails, but they also don’t appreciate daily outreach.

A typical sequence might include:

- Day 1: Initial personalized email

- Day 4: Follow-up, adding additional value (relevant case study or resource)

- Day 8: Different angle highlighting specific pain point

- Day 15: Final attempt, acknowledging they may not be interested now but offering to stay in touch

Five to six touches over three weeks represents a reasonable balance. Beyond that, you’re likely annoying rather than persistent.

Phone and Direct Outreach

Despite reports of its demise, phone outreach still works for reaching IT decision-makers—if executed properly.

Bypassing gatekeepers in enterprise environments requires strategy. Calling the main number and asking for the VP of IT rarely succeeds. Instead, use LinkedIn or ZoomInfo to find direct dial numbers or extensions.

Call early (7:00-8:30 AM) or late (5:30-7:00 PM) when decision-makers are at their desks but administrative staff have left. IT professionals, particularly infrastructure managers, often work outside standard business hours.

If you reach an assistant, be direct and respectful: “I’m trying to reach John regarding Cisco infrastructure—is he the right person or should I speak with someone else on his team?” This positions you as someone who might already have a relationship and respects their time by asking for the right contact.

Voicemail scripts should be brief and create curiosity without overselling. “Hi John, this is Sarah Chen calling about the Catalyst 3850 end-of-life situation. I’ve worked with several healthcare networks navigating this transition and wanted to share a few insights that might be valuable. My number is [number], or feel free to email me at [email].”

This demonstrates relevance (3850 EOL), credibility (worked with similar organizations), and offers value (insights, not a pitch). Keep it under 30 seconds.

Best times to reach IT professionals vary by role. CIOs rarely answer unexpected calls during business hours. Network engineers and infrastructure managers are more accessible, particularly during the first and last hours of their workday.

Avoid Mondays (they’re catching up from the weekend) and Fridays after 2:00 PM (mentally checked out). Tuesday through Thursday, 7:30-9:00 AM shows the strongest connection rates in most industries.

Warm introduction strategies through mutual connections dramatically improve response rates. Before cold calling, check for shared LinkedIn connections. A brief message asking a mutual contact for an introduction often succeeds: “I noticed you’re connected with John Smith at [Company]. I work with organizations managing Cisco infrastructure, and I thought I might offer value to John’s team. Would you be comfortable making an introduction?”

Account-Based Marketing (ABM)

For high-value target accounts—enterprise organizations with substantial Cisco deployments and large potential deal sizes—coordinated account-based approaches justify the investment.

Coordinating sales and marketing for target accounts ensures consistent messaging and maximizes touchpoints. While your sales rep pursues direct outreach, marketing should be running targeted LinkedIn ads, email campaigns, and potentially direct mail to multiple stakeholders at the same account.

This multi-threaded approach prevents single points of failure. If the VP of Infrastructure isn’t responsive, you’re simultaneously building awareness with the Director of Security and the network architecture team.

Personalized content for different stakeholder levels acknowledges that CIOs care about different things than network engineers. Create account-specific content:

- Executive brief on network modernization ROI for the CIO

- Technical architecture guide comparing approaches for the network architect

- TCO analysis for the procurement team

- Implementation case study from a similar organization for the project manager

Each piece addresses that stakeholder’s specific concerns and decision criteria.

Multi-touch attribution in complex sales cycles helps you understand which activities actually influence deals. Did the executive attend your webinar? Did the engineer download the technical whitepaper? Did the CIO engage with your LinkedIn ad?

Understanding these patterns allows you to optimize resource allocation for future target accounts.

Executive sponsorship programs leverage your own leadership to access theirs. Having your CTO or VP of Engineering offer to speak with their CTO or VP of Infrastructure creates peer-level conversations that build credibility and often accelerate decision-making.

Content and Messaging That Resonates

Demonstrating Technical Credibility

IT decision-makers have finely tuned BS detectors. Demonstrating genuine understanding of their environment isn’t optional; it’s the price of admission.

Speaking the language means using Cisco terminology correctly. Don’t say “router” when you mean “Layer 3 switch.” Understand the difference between Catalyst and Nexus platforms. Know that IOS-XE and IOS-XR are different operating systems with different capabilities.

When you reference specific Cisco products correctly and demonstrate understanding of their strengths and limitations, you signal competence. When you fumble basic terminology, you signal that you’re a salesperson reading from a script.

Referencing specific product lines and versions shows current knowledge. Talking about “Cisco routers” sounds generic. Discussing “the transition from ASR 1000 series to Catalyst 8000V for SD-WAN deployments” demonstrates you understand current technology directions.

Know which products are current, which are end-of-life, and which are legacy but still widely deployed. This knowledge informs relevant conversations.

Understanding integration challenges and ecosystems matters enormously. Cisco equipment doesn’t exist in isolation. It integrates with cloud providers, security information and event management (SIEM) systems, network monitoring tools, and identity management platforms.

Speak knowledgeably about how your solution fits into these ecosystems. “We integrate directly with Cisco DNA Center’s northbound APIs” means something specific to network architects. “We work with Cisco” means almost nothing.

Case studies from similar Cisco environments provide proof and reduce perceived risk. “Here’s how we helped a 400-bed hospital system running Cisco Catalyst switches and Firepower firewalls reduce security incidents by 65%” gives a decision-maker at a similar organization confidence that you understand their specific context.

Generic case studies, “We helped an IT department improve security,” fail to create the same confidence.

Value Propositions by Stakeholder Level

Different stakeholders care about different outcomes. Tailor your messaging accordingly.

C-Suite messaging focuses on business impact, strategic alignment, and risk. CIOs want to hear about:

- How does your solution reduce operational costs or enable revenue opportunities?

- Risk mitigation—reduced downtime, improved security posture, and regulatory compliance

- Strategic capabilities—supporting digital transformation, enabling new business models

- Vendor consolidation and simplified management

A compelling CIO message: “We’ve helped three healthcare systems similar to yours consolidate network monitoring across Cisco infrastructure, reducing mean time to resolution by 45% while cutting tool costs by $200,000 annually. This freed up your team to focus on strategic initiatives rather than firefighting.”

IT Director messaging emphasizes operational efficiency, team productivity, and solving day-to-day pain points:

- Reducing manual work and human error

- Improving visibility and control

- Enhancing security without adding complexity

- Making their teams more effective with existing resources

For a Director of Infrastructure: “Your team is likely spending 15-20 hours weekly on manual configuration management across your Cisco environment. Our automated approach reduces that to under 2 hours while eliminating config drift and compliance issues.”

Technical user messaging gets into specifics—features, integrations, and technical specifications:

- Detailed integration capabilities with Cisco platforms

- API availability and automation support

- Performance characteristics and scalability

- Security architecture and compliance certifications

For a network architect: “We integrate with Cisco ISE through pxGrid for real-time policy enforcement, support NetFlow and IPFIX for traffic analysis, and provide REST APIs for automation workflows you’re likely already building.”

Content Formats That Work

Technical whitepapers and architecture guides serve engineers and architects evaluating solutions. A detailed document explaining exactly how your solution integrates with Cisco DNA Center, what APIs it uses, and how it handles failover scenarios gives technical evaluators the information they need.

These don’t need marketing polish—they need technical accuracy and depth. In fact, overly designed whitepapers sometimes reduce credibility with technical audiences who prefer substance over style.

Webinars featuring Cisco integration demonstrations allow you to showcase capabilities while fielding questions. A 45-minute technical deep-dive showing your solution working with actual Cisco equipment resonates strongly with technical buyers.

Include Q&A time—the questions reveal what matters to your audience and give you opportunities to address concerns directly.

Comparison guides and competitive positioning help decision-makers understand options. A thoughtful comparison of approaches—your solution versus building in-house, using native Cisco tools, or implementing competitive alternatives—demonstrates confidence and helps buyers think through tradeoffs.

Avoid badmouthing competitors. Instead, acknowledge their strengths while explaining why your approach might better fit specific use cases.

ROI calculators and TCO analyses arm champions with business case ammunition. A tool that lets them input their specific environment—number of switches, engineer salaries, current downtime metrics—and generates credible cost savings projections accelerates internal approvals.

Make assumptions transparent and conservative. Inflated ROI claims undermine credibility.

Video demonstrations and proof-of-concept walkthroughs show rather than tell. A 5-minute video showing your solution automatically discovering their Cisco infrastructure, identifying vulnerabilities, and generating remediation recommendations often communicates more effectively than a 20-page document describing the same capabilities.

Building Relationships and Trust

Establishing Expertise

IT decision-makers are more likely to engage with peers and experts than with salespeople. Positioning yourself as a knowledgeable resource changes the dynamic.

Industry certifications and partnerships provide external validation. Cisco certifications (CCNA, CCNP, CCIE) signal genuine technical knowledge. Even if you’re not personally certified, having certified engineers on your team demonstrates commitment to technical excellence.

Partnership status with Cisco or complementary vendors (security vendors, cloud providers, systems integrators) suggests legitimacy and market acceptance.

Speaking at relevant conferences establishes thought leadership. A presentation at Cisco Live, regional VMUG meetings, or industry-specific technology conferences positions you as an expert worth listening to.

These speaking opportunities also generate direct leads—attendees often approach speakers after sessions with specific questions or challenges.

Publishing thought leadership through blog posts, industry publications, or contributed articles demonstrates expertise and creates discoverable content. When a VP of Infrastructure researches “Cisco SD-WAN migration challenges” and finds your comprehensive guide appearing in search results, you’ve created awareness without cold outreach.

Focus on genuinely helpful content addressing real challenges, not thinly veiled product pitches.

Contributing to technical communities and forums like Reddit’s r/networking, Cisco Support Community, or industry Slack channels builds a reputation over time. Consistently providing helpful answers to technical questions makes your name familiar and associates you with expertise.

When you eventually reach out for a sales conversation, you’re not a stranger—you’re “that person who helped me solve the BGP issue on Reddit.”

Providing Value Before Selling

The best salespeople give before they ask. This approach works particularly well with skeptical IT audiences.

Free audits or assessments offer concrete value. “I’d be happy to review your current Cisco environment and provide a brief assessment of security posture and potential optimization opportunities—no strings attached” often gets accepted when direct sales pitches get ignored.

Deliver genuine value in these assessments. Don’t simply create a list of problems your product solves. Provide actionable insights they can implement regardless of whether they buy from you.

Sharing relevant industry research and benchmarks positions you as a valuable resource. “I just saw this report on average WAN costs in healthcare and thought it might interest you, given your multi-site environment.” provides value without asking for anything in return.

Over time, these small gestures build goodwill and keep you top-of-mind.

Introducing helpful connections or resources demonstrates that you’re thinking about their success, not just your commission. “I can’t help directly with your wireless deployment, but I know an excellent consultant who specializes in healthcare wireless design. Happy to make an introduction,” builds trust and often gets reciprocated.

Educational content without an immediate sales agenda might include hosting a lunch-and-learn on industry trends, sharing technical best practices, or offering workshops on topics relevant to their environment.

These investments pay dividends through relationship building and positioning, even when they don’t immediately generate opportunities.

Navigating Long Sales Cycles

Enterprise infrastructure purchases aren’t impulse buys. From initial contact to signed contract often spans 6-12 months or longer.

Staying top-of-mind requires consistent, valuable touchpoints without becoming annoying. A monthly email sharing relevant content, quarterly check-ins offering to discuss industry developments, or periodic invitations to relevant events, maintain the relationship during long evaluation cycles.

Vary your outreach—mix emails, LinkedIn messages, phone calls, and event invitations to avoid pattern fatigue.

Building relationships with multiple stakeholders prevents single points of failure. If you’ve only connected with the Director of Infrastructure and she leaves the company mid-evaluation, you’re starting over. Relationships with the architect, the security team, and the VP level ensure continuity through personnel changes.

Understanding and respecting procurement timelines demonstrates professionalism. If a prospect says they’re finalizing budgets in October for January implementation, pushing for an August decision annoys rather than accelerates. Instead, ask, “What information would be helpful for your budget planning process?”

Patience and persistence, balanced with respect, is the ultimate challenge. You must remain engaged and visible without being pushy or desperate. When someone says “not now,” ask “when would be a better time to reconnect?” and honor that timeline.

Tools and Technologies for Reaching Decision-Makers

Sales Intelligence Platforms

ZoomInfo, Apollo.io, and Cognism provide contact data, technology intelligence, and company information that fuel targeted outreach. These platforms typically offer:

- Direct dial phone numbers and verified email addresses

- Technology stack information (what Cisco products they use)

- Company firmographics (revenue, employee count, locations)

- Org charts and reporting structures

- News and trigger events

Expect to invest $10,000 to $30,000 annually for quality sales intelligence platforms, but the targeting precision and time savings justify the cost for serious B2B sales teams.

Bombora and similar intent data providers track which companies are actively researching topics related to your solution. If a company’s employees are heavily consuming content about Cisco SD-WAN migration, they’re likely in-market for related solutions.

Intent data helps prioritize outreach—focus on accounts showing active research behaviors rather than cold outreach to dormant accounts.

6sense or Demandbase provides account intelligence combining intent data, technographic information, and engagement tracking to identify accounts most likely to buy and their current stage in the buying journey.

These platforms typically target enterprise sales teams with longer sales cycles and larger deal sizes, where the investment ($50,000 or more annually) makes sense.

Outreach and Engagement Tools

Outreach.io, SalesLoft, or Apollo enable sophisticated multi-channel sequencing, automating follow-up while maintaining personalization. These platforms let you:

- Create sequences combining email, phone, LinkedIn, and other touchpoints

- A/B test messaging variations

- Track engagement and optimize based on data

- Integrate with CRM for full visibility

The automation handles repetitive tasks while you focus on high-value personalized interactions with engaged prospects.

LinkedIn Sales Navigator’s advanced search capabilities let you filter prospects by company, title, keywords, geography, and other criteria. Save searches and receive alerts when new prospects match your criteria or when saved leads change jobs or post content.

The $80 to $100 monthly cost represents the best value in B2B sales tools for most professionals.

Email verification tools like Hunter.io or NeverBounce reduce bounce rates and protect sender reputation by verifying email addresses before sending. This matters increasingly as email providers crack down on spam and low-quality outreach.

CRM integration best practices ensure tools work together rather than creating data silos. Your sales intelligence platform should sync contact data into Salesforce or HubSpot. Engagement from Outreach should log automatically to CRM records. This integration provides complete visibility into prospect interactions.

Research and Monitoring

Google Alerts for company names, executive names, and relevant keywords provide ongoing intelligence about target accounts. Set alerts for:

- Your target company names (to track news, announcements, expansions)

- “Cisco + [specific product] + [industry]” to find discussions and implementations

- Competitor names to understand market dynamics

BuiltWith or Wappalyzer verifies technology stacks by analyzing public-facing websites. While less comprehensive than dedicated sales intelligence platforms, these browser extensions provide quick verification of web technologies and sometimes infrastructure choices.

Company review sites like G2, TrustRadius, or Gartner Peer Insights reveal what current customers think about various solutions. Read reviews from IT professionals at companies similar to your prospects to understand what matters to them and what complaints arise with competitive solutions.

This intelligence informs your messaging and helps you avoid pitfalls that frustrate buyers.

Common Mistakes to Avoid

Tactical Errors

Generic outreach ignoring specific Cisco environments represents the most common mistake. Sending the same “We help IT departments improve security” message to everyone wastes everyone’s time. Decision-makers immediately recognize mass outreach and delete it.

If you mention Cisco at all, be specific. Reference their likely products, their industry-specific challenges, or their particular use cases.

Reaching out to the wrong stakeholders or bypassing important influencers damages relationships. Going straight to the CIO when you should start with the Director of Infrastructure often backfires. The director feels disrespected, and the CIO forwards you back down anyway—but now with a negative introduction.

Understand the decision-making hierarchy and engage appropriately. When in doubt, start one level lower than you think necessary.

Overly aggressive follow-up damages relationship potential. Five emails in five days signal desperation, not persistence. If someone hasn’t responded after a reasonable outreach sequence (five to six touches over three weeks), they’re not interested or not ready. Move on and try again next quarter.

Failing to research company-specific challenges before reaching out shows disrespect for their time. If a company just announced a major acquisition, reference it. If they’re in an industry facing new regulations, acknowledge it. This research takes five minutes and dramatically improves response rates.

Messaging Mistakes

Over-emphasizing features without business outcomes loses audiences quickly. IT decision-makers don’t care that your solution has 47 features—they care about solving specific problems. Connect features to outcomes: “Our automated config management reduces change-related outages by 70%” rather than “We offer automated config management.”

Using jargon incorrectly or demonstrating a lack of technical knowledge destroys credibility permanently. If you’re going to reference technical concepts, get them right. Saying “Cisco routers and modems” when you mean “routers and switches” immediately identifies you as someone who doesn’t understand networking.

When unsure about technical details, speak in business terms rather than butchering technical concepts.

Badmouthing Cisco or competitive vendors rarely works and often backfires. Decision-makers chose their current vendors for reasons. Attacking those choices implicitly criticizes their judgment.

Instead, acknowledge legitimate strengths of current solutions while explaining why your approach might better address specific use cases or new requirements.

Making unrealistic promises or timelines to close deals damages long-term relationships and credibility. If implementation realistically takes three months, don’t promise six weeks. If ROI typically takes 18 months, don’t project break-even in six months.

IT professionals have long memories. Overpromising and underdelivering end relationships and generate negative word-of-mouth in tight-knit professional communities.

Strategic Missteps

Ignoring the broader vendor ecosystem and partnerships misses important dynamics. Cisco customers often work with strategic systems integrators, managed service providers, or consulting firms that influence technology decisions.

Understanding these relationships helps you navigate buying processes and potentially leverage partnerships rather than fighting them.

Underestimating decision-making complexity in enterprises leads to unrealistic pipeline forecasting. A verbal commitment from an infrastructure director doesn’t mean a signed contract in 30 days. Multiple stakeholders, procurement processes, legal reviews, and budget approvals all take time.

Factor realistic timelines into your forecasts and resource planning.

Poor timing relative to budget cycles wastes effort. Engaging a prospect in December when they’ve finalized budgets for the following year means waiting until next cycle unless you’ve identified emergency funding.

Research fiscal years and budget planning timelines for target accounts to time outreach appropriately.

Lack of coordination between marketing and sales creates confusing prospect experiences. If marketing is running ads promoting one message while sales is leading with different value propositions, prospects receive mixed signals that undermine both efforts.

Align messaging, coordinate multi-touch campaigns, and ensure consistent positioning across all prospect touchpoints.

Measuring Success and Optimization

Key Metrics to Track

Response rates by channel and message variation reveal what’s working. Track:

- Email open rates (15-25% is typical for targeted B2B)

- Email reply rates (2-5% for cold outreach, 10-15% for warm)

- LinkedIn connection acceptance rates (20-40% for personalized requests)

- Phone connection rates (5-10% is typical)

- Meeting booking rates (20-30% of replies should convert to meetings)

Compare performance across message variations, subject lines, and outreach channels to optimize resource allocation.

Meeting conversion rates measure how effectively you’re moving prospects through your process:

- First meeting to second meeting (target 50-60%)

- Discovery call to technical evaluation (target 40-50%)

- Technical evaluation to business case (target 60-70%)

- Business case to negotiation (target 70-80%)

Weak conversion at any stage signals where to focus improvement efforts.

Pipeline velocity and deal size indicate overall effectiveness. Track:

- Average time from first contact to closed deal

- Average deal size for Cisco-environment customers

- Win rates by company size, industry, and specific Cisco products deployed

These metrics help forecast revenue and identify your most profitable target profiles.

Cost per qualified opportunity reveals efficiency. Calculate total sales and marketing costs divided by the number of qualified opportunities generated. Understanding this metric allows you to evaluate channel effectiveness and justify budget allocations.

Win rates in Cisco-centric accounts compared to overall win rates indicate whether your Cisco-focused approach creates a competitive advantage. If you’re winning 35% of opportunities overall but 50% with Cisco customers, you’ve validated your targeting strategy.

A/B Testing Approaches

Subject line and opening sentence variations can dramatically impact response rates. Test:

- Questions vs. statements (“Managing Cisco configs manually?” vs. “Automated Cisco config management”)

- Specific vs. general (“Cat 3850 EOL planning” vs. “Network refresh planning”)

- Value-focused vs. feature-focused (“Reduce network downtime 45%” vs. “Advanced network monitoring”)

Send variant A to half your list, variant B to the other half, and measure which generates better response rates.

Value propositions and pain point messaging benefit from systematic testing. Try emphasizing different pain points (cost reduction vs. risk mitigation vs. operational efficiency) to discover what resonates most strongly with different segments.

Outreach timing and frequency significantly impact results. Test:

- Day of week (Tuesday to Thursday typically outperform Monday and Friday)

- Time of day (early morning and late afternoon often work best)

- Follow-up intervals (3 days vs. 5 days vs. 7 days between touches)

Content formats and offers vary in effectiveness. Test whether technical whitepapers, recorded demos, live webinars, or assessment offers generate better engagement with your target audience.

Continuous Improvement

Win/loss analysis and buyer interviews provide invaluable insights. When you win deals, interview buyers to understand what influenced their decision. When you lose, ask what you could have done differently.

These conversations reveal messaging that resonates, competitive weaknesses to exploit, and process improvements to implement.

Sales team feedback loops surface patterns individual reps might miss. Regular sessions sharing what’s working and what’s not create collective learning. The message that flopped for one rep might work well for another’s accounts.

Market intelligence updates ensure you stay current with Cisco’s product roadmap, competitive landscape, and industry trends. Subscribe to Cisco’s partner communications, monitor networking industry news sources, and track competitor announcements.

Adapting to Cisco product and strategy changes keeps your approach relevant. When Cisco shifts toward subscription licensing, cloud-managed infrastructure, or security convergence, your messaging must evolve to address new implications for customers.

Case Studies and Real-World Examples

Successful Outreach Campaign Examples

Targeting companies during Cisco EOL transitions consistently generates strong results. One security vendor identified 400 companies running Cisco ASA firewalls approaching end-of-life. They created a specific campaign:

- Email sequence addressing ASA EOL timeline and migration options

- Technical whitepaper comparing migration paths

- Recorded webinar showing the migration process

- Offer for free security posture assessment

The campaign generated 87 qualified opportunities over six months with a 42% win rate—significantly above their typical 28% win rate. The key was extreme relevance: these companies faced a forced decision, and the vendor provided valuable guidance regardless of the ultimate purchasing decision.

ABM success with Fortune 500 Cisco user: A network automation vendor targeted a Fortune 500 financial services company running extensive Cisco infrastructure across 300 branches. Rather than cold outreach, they:

- Identified six key stakeholders from network architecture to security to operations

- Created personalized content for each stakeholder level

- Had their CTO offer to present at the prospect’s quarterly IT leadership meeting

- Provided a free pilot implementation at three branches

The 14-month sales cycle resulted in a $2.3 million initial contract. The multiple stakeholder relationships proved critical when their primary champion left the company mid-evaluation—other relationships ensured continuity.

LinkedIn engagement leading to an enterprise deal: A professional services firm consistently shared valuable content about Cisco network transformation on LinkedIn for six months. Their VP of engineering regularly commented on posts from IT leaders at target accounts, offering insights without pitching services.

One infrastructure director at a healthcare system noticed these thoughtful contributions and reached out directly, asking for advice on SD-WAN migration. That conversation led to a consulting engagement that grew into a $1.8 million network transformation project.

The lesson: consistent value-creation and thought leadership generate inbound interest from high-quality prospects.

Lessons from Failed Approaches

Bypassing key influencers: A cloud networking vendor successfully connected with the CIO at a mid-market retailer and received encouraging signals. They focused entirely on the executive relationship while ignoring the network engineering team.

The engineers, feeling disrespected and concerned about operational implications, raised technical objections during evaluation. The CIO, unwilling to override his team, ended the process. The vendor had won the executive but lost the deal by alienating the people who would actually implement and manage the solution.

Poor timing and research: A network monitoring vendor reached out to a hospital system in December, promoting better visibility into network performance. Unbeknownst to the vendor, the hospital had just completed a major Epic EHR implementation that consumed their entire annual IT budget and left the team exhausted.

The timing couldn’t have been worse. A brief research would have revealed the implementation timeline and suggested waiting until the following year, when the team would be ready to consider optimization projects.

Recovery from initial missteps: Sometimes you can salvage relationships after mistakes. One salesperson sent a poorly researched, generic email to a VP of Infrastructure. The VP responded tersely, pointing out factual errors about their environment.

Rather than defend the mistake or disappear, the salesperson sent a genuine apology acknowledging the poor research, admitted it was inexcusable, and offered to do better. Six months later, after consistently sharing relevant content with no sales pitch, she earned a conversation. The relationship eventually generated a significant opportunity.

The lesson: humility and genuine course-correction can overcome initial mistakes, though it’s better to avoid them entirely.

Future Trends and Considerations

Evolving Cisco Landscape

Shift to subscription and cloud-based offerings fundamentally changes buying patterns. Cisco’s transition from perpetual license capital expenditures to subscription-based operational expenditures affects how companies budget, when they buy, and who controls purchasing decisions.

As infrastructure becomes cloud-managed services rather than on-premises hardware, procurement processes shorten, but ongoing relationship management becomes more critical. This shift creates opportunities for solutions that help organizations manage subscription complexity or optimize cloud networking costs.

The impact of AI and automation on IT decision-making reduces manual network management tasks but creates new requirements for skills and tools. As Cisco embeds AI into DNA Center and other management platforms, customer needs evolve from basic monitoring to predictive analytics and autonomous remediation.

Solutions that complement or enhance AI-driven management find growing audiences.

Cisco’s partnerships and ecosystem evolution, particularly with cloud providers (AWS, Azure, Google Cloud) changes what “Cisco infrastructure” means. Increasingly, Cisco deployments span on-premises data centers and public cloud environments, creating needs for hybrid management, consistent security policies, and unified visibility.

Understanding these hybrid architectures becomes essential for reaching decision-makers managing evolving infrastructure.

Changing Buyer Behaviors

Increased self-service research before engagement means buyers reach out to vendors later in their buying journey with more specific requirements and fewer vendors in consideration. By the time you receive an RFP, finalists have often been predetermined through extensive independent research.

This shifts focus toward early-stage thought leadership and content that shapes buyer perspectives before they enter active evaluation.

Committee-based buying and consensus requirements replace individual decision-maker authority in many organizations. Technology purchases increasingly require alignment across infrastructure, security, applications, finance, and business unit stakeholders.

Sales strategies must account for multiple decision criteria and build relationships across stakeholder groups rather than relying on single champion relationships.

Preference for consultative versus transactional relationships grows as technology environments increase in complexity. Buyers increasingly value vendors who help them think through strategic challenges, not just vendors offering commodity products at competitive prices.

This favors sales approaches emphasizing expertise, problem-solving, and partnership over purely transactional product sales.

Adaptation Strategies

Staying current with Cisco product roadmaps ensures your messaging addresses where customers are headed, not just where they’ve been. Subscribe to Cisco partner communications, attend Cisco Live virtually or in-person, and maintain relationships with Cisco account teams who often know customer plans before those customers engage other vendors.

Evolving messaging as infrastructure priorities shift prevents your value propositions from becoming dated. As priorities move from basic connectivity to security convergence to AI-driven operations, your messaging must address current challenges rather than yesterday’s pain points.

Building for long-term relationship value rather than quarterly quota achievement creates sustainable competitive advantage. IT decision-makers change roles but often remain in the same industry or geography. The infrastructure director you help today may be the CIO who gives you a significant opportunity three years from now.

Play the long game with relationship development, even when short-term sales don’t materialize.

Conclusion and Action Plan

Reaching IT decision-makers in companies using Cisco infrastructure requires strategic targeting, genuine expertise, and patient relationship development. These organizations represent some of the most attractive B2B technology prospects—they have budgets, complex problems to solve, and predictable buying cycles.

Success comes from understanding both the technical environment and the human dynamics of enterprise decision-making. Know the difference between Catalyst and Nexus platforms. Understand that CISOs care about different things than network engineers. Recognize that trigger events like end-of-life announcements or mergers create urgency that shortcuts normal timelines.

Your 30-60-90 day implementation roadmap:

Days 1-30: Foundation

- Identify 50-100 target accounts using technology intelligence platforms

- Map key stakeholders at priority accounts using LinkedIn

- Set up monitoring for trigger events (Google Alerts, news feeds, Cisco EOL schedules)

- Develop core messaging tailored to Cisco environments

- Create or adapt 2-3 key content pieces (case study, technical guide, ROI analysis)

Days 31-60: Engagement

- Launch initial outreach sequences to target stakeholders

- Test message variations and track response rates

- Begin LinkedIn engagement through thoughtful commenting and content sharing

- Conduct first 10-15 discovery conversations

- Refine messaging based on early feedback

Days 61-90: Optimization

- Analyze which approaches generated the best response and conversion rates

- Double down on high-performing channels and messages

- Develop account-based strategies for the highest-potential targets

- Build relationships with multiple stakeholders at key accounts

- Create a feedback loop incorporating win/loss insights

Resources for ongoing learning:

- Cisco’s annual security and networking reports

- Industry analyst research (Gartner, Forrester, IDC)

- Technical communities (r/networking, Cisco Support Community)

- Professional networking groups (LinkedIn CIO forums, local IT leadership groups)

- Cisco Live sessions (available on-demand even if you don’t attend)

The fundamentals remain constant: research thoroughly, provide value generously, communicate relevantly, and persist patiently. IT decision makers appreciate vendors who understand their challenges, respect their expertise, and offer genuine partnership rather than transactional relationships.

Start with the target account research this week. Identify twenty companies running Cisco infrastructure that match your ideal customer profile. Map their stakeholders. Research their specific challenges and trigger events. Then craft personalized outreach that demonstrates you understand their world.

The pipeline you build through this focused, expertise-driven approach will outperform scatter-shot outreach by orders of magnitude. More importantly, you’ll build a reputation as a trusted resource in your market—an asset that compounds in value over time.